Published by Ben Goethel

My running New Year’s Resolution for the past five years has been to give up caffeinated soda. But by January 3rd, I’m usually right back in the habit. Realizing my result will most likely be similar this year, I’ve decided to make some easier-to-implement financial resolutions. Not only are these resolutions easier to follow through on, they can also have a significant impact on your financial future. Here are three options for those looking for some ideas of their own!

Fully Fund an IRA

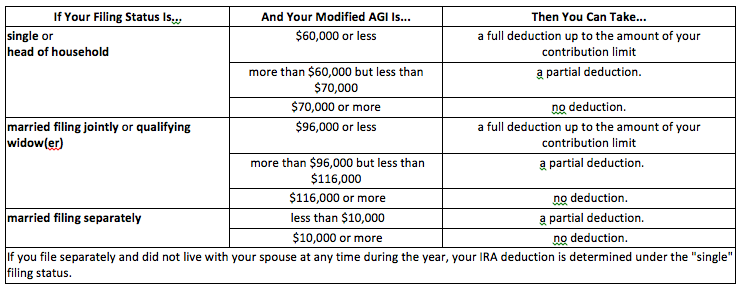

Maybe you’re flush with cash from a Christmas bonus but don’t know what to do with it. Consider contributing those funds to an IRA. Whether you have a Traditional or Roth IRA, your total contributions to all of your IRAs cannot be more than $5,500 (or $6,500 if you’re age 50 or older). Contributions to a Traditional IRA can be tax-deductible but may be limited if you or your spouse are covered by a retirement plan at work and your income exceeds certain levels, as shown in the following chart:

Source: https://www.irs.gov/Retirement-Plans/Plan-Participant,-Employee/2014-IRA-Contribution-and-Deduction-Limits-Effect-of-Modified-AGI-on-Deductible-Contributions-If-You-ARE-Covered-by-a-Retirement-Plan-at-Work

Update Estate Planning Documents

When was the last time you looked at your estate planning documents? Think about everything that has happened in your life since then. Estate Planning is about more than avoiding taxes and designating beneficiaries. Do you have minor children? Have you designated who could become their guardian in the event of your death? Or in the event of your incapacitation, who do you want making health and financial decisions for you on your behalf? If you haven’t met with an estate planning attorney in the past five years, this could be an easy-to-implement resolution.

Evaluate Insurance Coverage

In addition to auto and homeowners insurance, consider an umbrella liability insurance policy, especially if your assets exceed the liability coverage provided by your other property and casualty policies. Ask your insurance representative for quotes on disability and life insurance coverage and purchase supplemental coverage if you need more. You may also want to consider purchasing long-term care insurance, as the costs of health care can have a detrimental impact on your financial legacy.

Contact your Wealth Advisor or a member of the Wealth Enhancement Group to get started on your 2015 Financial New Year’s Resolutions!